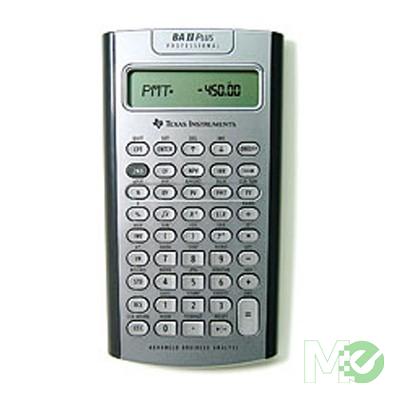

Texas Instruments BAII PLUS Pro Financial Calculator

Product Info

The BA II PLUS PROFESSIONAL features even more time-saving calculations to make short work of complex equations.

It's ideal for finance, accounting, economics, investment, statistics, and other business classes, as well as on the Chartered Financial Analyst (CFA®) exam

Features

The best-selling financial calculator from Texas Instruments just got better!

In addition to standard capabilities such as time-value-of-money, accrued interest, amortization, cost-sell-margin, and depreciation, the BA II PLUS PROFESSIONAL also includes:

- Net Future Value (NFV)

- Modified Internal Rate of Return (MIRR)

- Modified Duration

- Payback

- Discount Payback

BAII PLUS™ PROFESSIONAL Tutorials

Punch the numbers and crunch the data! Animated tutorial movies developed by Atomic Learning and TI offer step-by-step instructions covering finance, real estate, accounting, marketing and statistics calculations.

Finance professors, instructors and wizards can supplement their curriculum with a DVD from eLearnabout.com. Finance professor Gerard T. Olson presents an entertaining look at "Time Value and the TI Financial Calculator."

The BAII PLUS PROFESSIONAL are approved for use on the following professional exams:

- Chartered Financial Analyst®* exam

- GARP® Financial Risk Manager (FRM®)** exam

*Chartered Financial Analyst® is a trademark owned by CFA Institute.

**GARP® and FRM® are trademarks owned by Global Association of Risk Professionals.

None are affiliated with or endorse TI products.

- Solves time-value-of-money calculations such as annuities, mortgages, leases, savings, and more.

- Generates amortization schedules

- Performs cash-flow analysis for up to 32 uneven cash flows with up to 4-digit frequencies; computes NPV and IRR

- Net Future Value (NFV)

- Modified Internal Rate of Return (MIRR)

- Modified Duration

- Payback and Discounted Payback

- Choose from 2 day-count methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call

- 4 methods for calculating depreciation, book value, and remaining depreciable amount: SL, SYD, DB, DB with SL cross-over

- Depreciation Schedules

- Bond prices and yield to call or maturity

- Prompted display guides you through financial calculations showing current variable and label

- BGN/END payment setting

- Partial years

- 10 user memories

- 10-digit display

- List-based one- and two-variable statistics with four regression options: linear, logarithmic, exponential and power

- Math functions include trigonometric calculations, natural logarithms, and powers

- Black protective pouch with quick reference card included

- One lithium 2032 battery included

- APD™ (Automatic Power Down) conserves power

- One-year limited warranty

Specifications

| Display | 10-digit display |

|---|---|

| Power | One lithium 2032 battery |